Taxes on 1600 paycheck

Rather you get one paycheck for the. These range from FICA taxes contributions to a retirement or 401k plan child support payments insurance premiums and uniform deductions.

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

SmartAssets Indiana paycheck calculator shows your hourly and salary income after federal state and local taxes.

. Is 1300 for each married taxpayer or 1600 for unmarried taxpayers. Your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate your biweekly paycheck. Calculate self-employment tax.

Apply the single payment method option 3. You can e-File 2021 Tax Returns until October 15 October 17 2022 but late filing or late tax payment penalties might apply if you owe taxes. The first 2 listed immediately below apply where the bonus is paid to you separately from your regular pay.

These are contributions that you make before any taxes are withheld from your paycheck. Find a Local Branch or ATM. AMT Exemption AMT Patch Capital Gains Taxes.

Basically under IRS rules companies have 3 options in calculating taxes on bonuses. 55000 a Year Salary After Taxes in 2022 By State Here is your estimated 55000 a year salary after taxes in 2022 for each state. Be informed and get ahead with.

So how much you earned until today. If you do know your rough bleneded income tax rate the pre-tax earnings for a period of time then you can quickly calculate pre-tax post-tax incomes. Income tax deductions Income tax deductions include taxes withheld federal state and local.

The Department of Revenue Administration has issued TIR 2021-003 to alert taxpayers to the passage of Senate Bill 3 Chapter 74 Laws of 2021 effective June 10 2021 which amends the RSA 77-A Business Profits Tax BPT to exclude the business income of a taxpayer received by reason of forgiveness of indebtedness under the Paycheck Protection. 1600 West Monroe Street Phoenix AZ 85007. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

What It Does Not Account For. Your Income Taxes Tax Details. Clients using a relay service.

Mortgage payments Car loans Student loans Medical bills Credit card payments Personal loans Timeshare payments. How Much Will Your Biweekly Paycheck Be. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

A paycheck stub is a document attached to an employees paycheck. F2-F6 with year-to-date information from your paycheck including income tax withheld. These standard deduction amounts are for 2021 Tax Returns that are due on April 18 2022.

E-file Your Taxes for Free. If you increase your contributions your. Annual Income Biweekly pay 48 weeks Biweekly pay 50 weeks Biweekly pay 52 weeks.

The remaining 1600 will be deducted from your bonus check. For an exempt or salaried employee the gross income is calculated by dividing the annual salary by the number of pay periods in a year. Too much can mean you wont have use of the money until you receive a tax refund.

Your after-tax income will change based on state taxes. Historically the most common work schedule for employees across the United States is an 8-hour day with 5-days per week. Alabama 43423 Alaska 45705 State Income Tax 000 0.

You dont need to factor in common living expenses like utilities and food or paycheck deductions like health insurance or 401k contributions. Katholische Kirche in Deutschland or Roman Catholic Church in Germany German. It may seem intimidating.

The Catholic Church in Germany German. Converted Untaxed Taxed. But you should include all types of debt like.

Römisch-katholische Kirche in Deutschland is part of the worldwide Catholic Church in communion with the Pope assisted by the Roman Curia and with the German bishopsThe current speaker ie the chairperson of the episcopal. There are a number of different payroll deductions that can be deducted from an employees paycheck each pay period. If you work 40 hours a week then converting your hourly wage into the weekly equivalent is easy as you would simply multiply it by 40 which means adding a zero behind the hourly rate.

If you have your paycheck in hand and do not know what the income tax rate is you can enter zero to convert a paycheck to other pay periods without estimating the impact of income taxes. Too little withheld means a bigger paycheck but a smaller refund or even tax due. Arizona 44492 Arkansas 43544 California 43891 Colorado 43774.

Your effective tax rate. Income Tax Filing Assistance. Clients using a TDDTTY device.

In general if you make 400 or more from self-employment you will need to file taxes. Or a health savings account or flexible spending account that money will come out of your paycheck before income and FICA taxes are applied. The gross income is 1600 2080.

Some of these payroll deductions are mandatory meaning that an employer is legally obligated to withhold. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

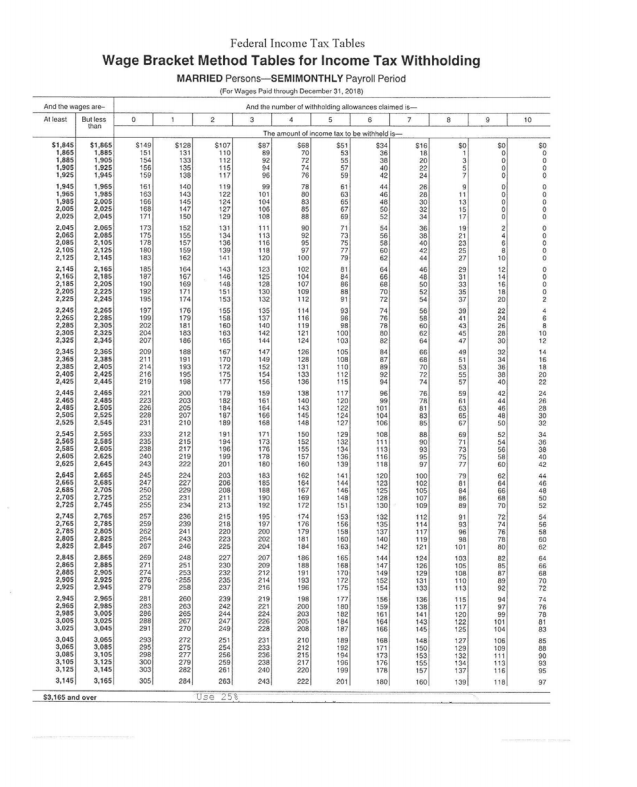

10 Federal Income Tax Tables Wage Bracket Method Chegg Com

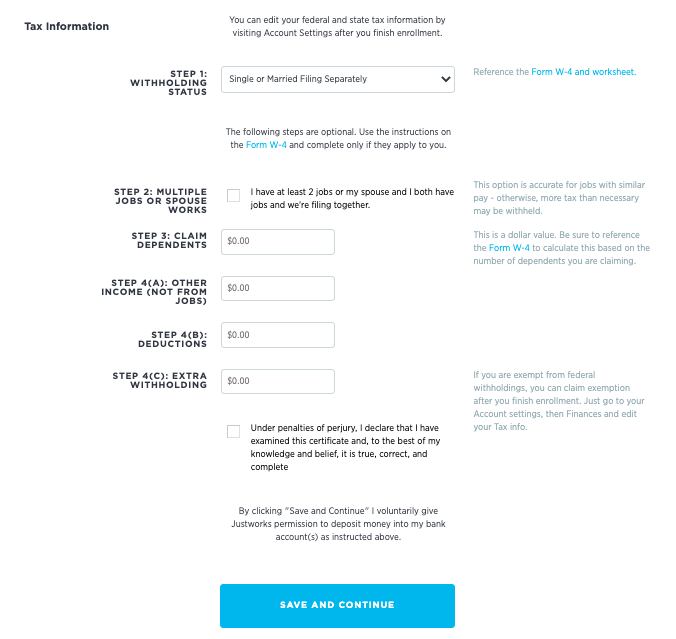

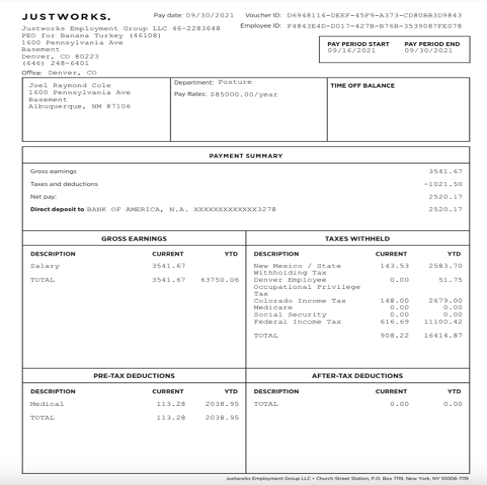

Questions About My Paycheck Justworks Help Center

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Texas Paycheck Calculator Smartasset

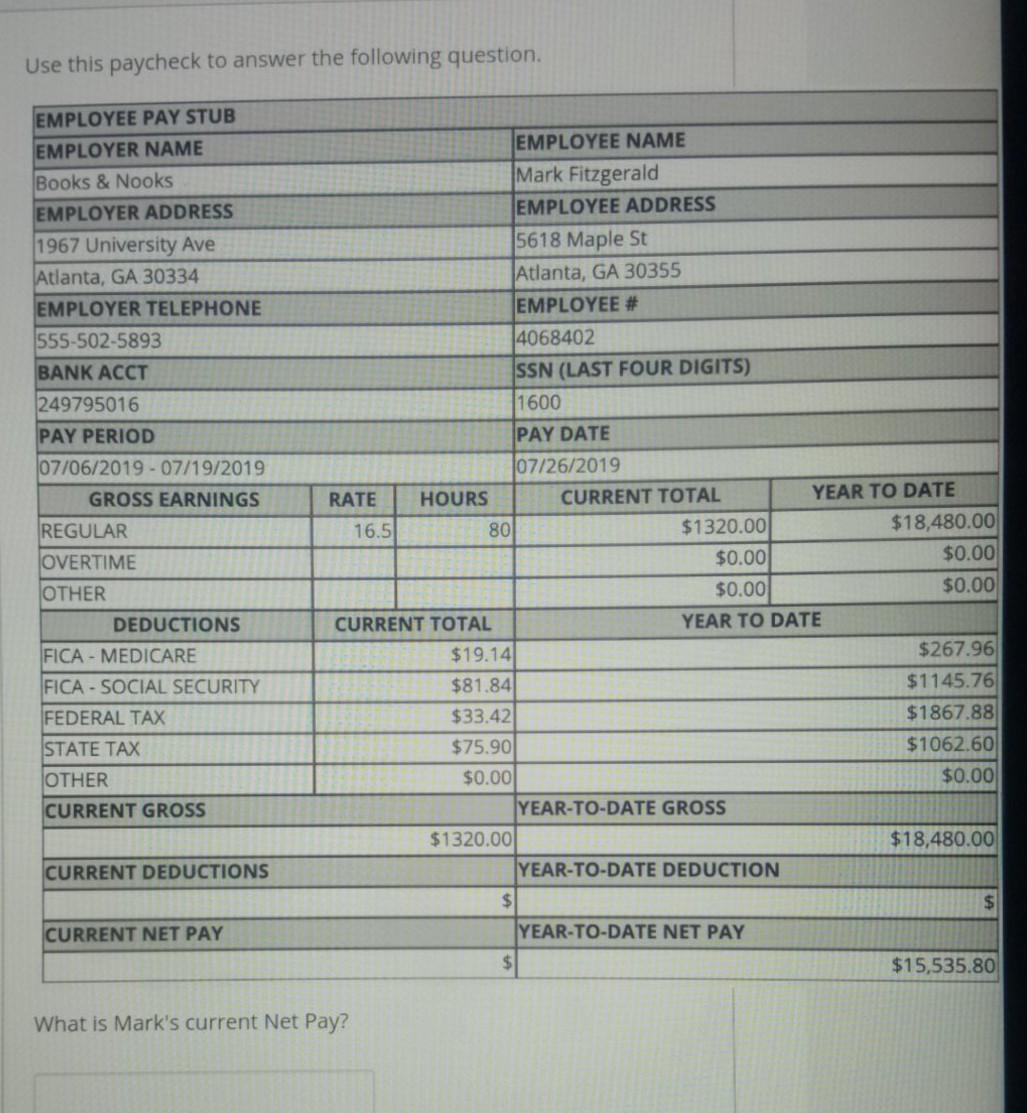

Solved Use This Paycheck To Answer The Following Question Chegg Com

Paycheck Tax Withholding Calculator For W 4 Tax Planning

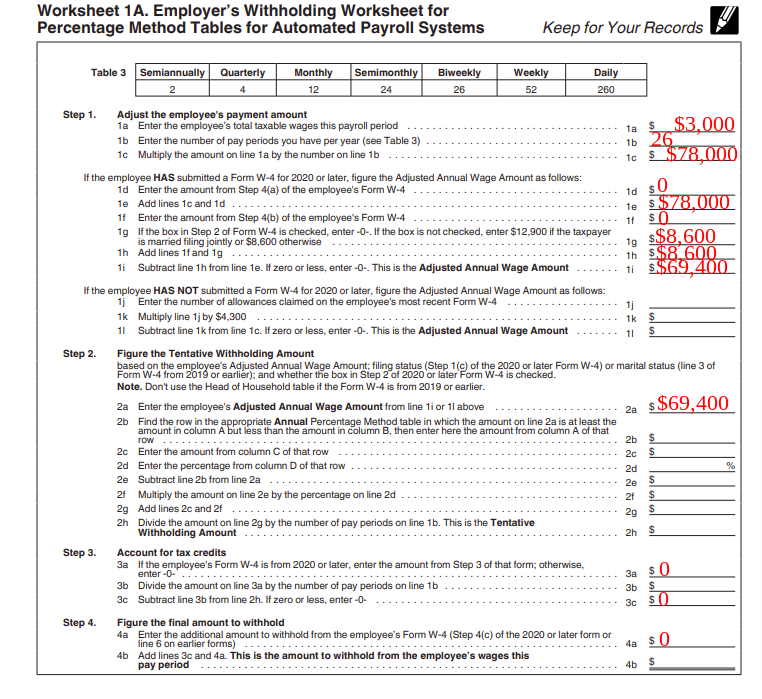

Chapter11 Current Liabilities And Payroll Accounting Ppt Video Online Download

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

1 600 After Tax Us Breakdown August 2022 Incomeaftertax Com

How To Calculate Payroll Taxes Methods Examples More

Questions About My Paycheck Justworks Help Center

Questions About My Paycheck Justworks Help Center

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Net Pay Step By Step Example

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll